How To Get Your Credit Score Up Fast

Pay twice a month.

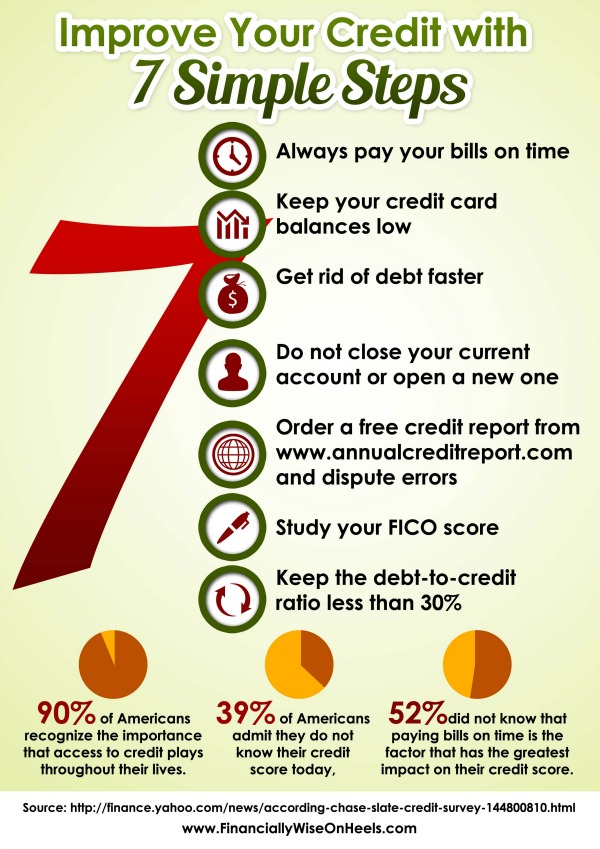

How to get your credit score up fast. Ask for higher credit limits. Petal visa credit card is one of the only credit cards you can get without credit history or an up front deposit and the current apr is overall pretty good for a secured credit card ranging from 14 49 25 49. Free credit report free credit score free credit monitoring experian boost experian creditlock 3 bureau credit report and scores compare all products instantly increase your credit scores for free. 7 ways to build credit fast 1.

As you focus on how to get your credit score up fast focus on developing healthy financial habits. Get credit for making utility and cell phone payments on time. This is a record of your payments on all accounts for the length of the account history. Go online and get a free copy of your credit report.

Even habits like sticking to a budget can give you more financial stability. When your credit limit goes up and your balance stays the same it instantly lowers. Pay your bills on time. The more you pay off your credit card balances each month the lower your overall credit utilisation will be bumping your credit score up.

Steps to improve your credit scores 1. Pay off debt and. Okay let s build on what you just learned about utilization ratios. You are entitled to one free report every year from each of the three main credit report agencies transunion experian and equifax.

Ideally you should do this regularly at least once a year. This will help you continue to increase your credit score over time. Call your credit card issuer and ask when your balance gets. Pay down debt strategically.

Increase your credit limit. Find out when your issuer reports payment history. Getting a secured credit card is one of the best and fastest ways to improve your credit score. If you ve been making utility and cell phone payments.

5 sneaky ways to improve your credit score 1. Your credit score is made up of five different factors that all impact your score in a different way. You can t deny that you stopped paying a credit card bill when you were unemployed last year. If you are able to make small payments often called micropayments throughout the month.

When lenders review your credit report and request a credit score for you they re very. Think of this as a report card for your finances. This also helps you keep interest chargers lower making it easier to get on top of your credit card debt so it is a win win. 30 total available credit.

This is what makes up your credit utilization ratio. Even if you re starting from a low point don t get discouraged. To determine your utilization ratio take the amount of outstanding balances on each account and divide it by your total credit limit.

/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)

/rapid-rescoring-to-raise-credit-scores-4144660-FINAL-5c1d95b9e00d44b8ad2e77529681d052.png)